Trading refers to the buying and selling of financial instruments such as stocks, bonds, currencies, and commodities. It is an integral part of the global economy and provides a platform for investors to make profits by speculating on the price movements of various assets. Trading can be done through various channels such as online platforms, brokerages, and exchanges.

To start trading, one needs to have a basic understanding of the financial markets, trading instruments, and trading strategies. One also needs to be aware of the risks involved in trading and have a solid risk management plan in place. Technical analysis and fundamental analysis are two popular methods used by traders to analyze market trends and make informed trading decisions. Trading psychology is also an important aspect of trading as it helps traders manage their emotions and make rational decisions.

Key Takeaways

- Trading involves buying and selling financial instruments to make a profit.

- To start trading, one needs to have a basic understanding of the financial markets, trading instruments, and trading strategies.

- Risk management, technical analysis, fundamental analysis, and trading psychology are important aspects of trading.

Basics of Trading

What Is Trading?

Trading is the act of buying and selling financial instruments, such as stocks, bonds, options, futures, and currencies, with the aim of making a profit. It is a way for investors to take advantage of market fluctuations and generate returns on their investments.

Trading can be done through a variety of channels, including online brokerages, traditional brokerages, and direct market access platforms. It can be done by individuals, institutions, and even automated trading systems.

Types of Trading

There are several types of trading, each with its own unique characteristics and strategies. Some of the most common types include:

- Day Trading: Day trading involves buying and selling securities within the same trading day, with the aim of profiting from short-term price movements. Day traders typically use technical analysis and charting tools to identify trading opportunities.

- Swing Trading: Swing trading involves holding a position for several days to several weeks, with the aim of profiting from medium-term price movements. Swing traders typically use a combination of technical and fundamental analysis to identify trading opportunities.

- Position Trading: Position trading involves holding a position for several weeks to several months, with the aim of profiting from long-term price movements. Position traders typically use fundamental analysis to identify trading opportunities.

- Scalping: Scalping involves making numerous trades throughout the day, with the aim of profiting from small price movements. Scalpers typically use technical analysis and high-frequency trading strategies to identify trading opportunities.

Each type of trading has its own advantages and disadvantages, and requires a different set of skills and strategies. Traders must carefully consider their goals, risk tolerance, and trading style before choosing a type of trading to pursue.

Financial Markets

Financial markets are critical components of the global economy. They are where securities trading occurs, including the buying and selling of stocks, bonds, currencies, commodities, and derivatives. These markets are essential to the smooth operation of capitalist economies and create liquidity for businesses and investors.

Stock Markets

Stock markets are where publicly traded companies issue and sell their stocks to the public. These markets are where investors can buy and sell shares of a company’s stock. The two most prominent stock markets in the United States are the New York Stock Exchange (NYSE) and the NASDAQ.

Forex Markets

The foreign exchange market, or Forex, is where currencies are traded. It is the largest and most liquid market in the world, with an average daily trading volume of over $5 trillion. The Forex market is where countries, companies, and individuals exchange currencies for various reasons, including international trade, tourism, and speculation.

Cryptocurrency Markets

Cryptocurrency markets are where digital currencies are bought and sold. These markets are relatively new, with the first cryptocurrency, Bitcoin, being introduced in 2009. Cryptocurrencies are decentralized and operate independently of banks and governments. The most popular cryptocurrency markets include Binance, Coinbase, and Kraken.

Commodity Markets

Commodity markets are where raw materials, such as gold, silver, oil, and agricultural products, are traded. These markets are essential to the global economy, as they provide the raw materials needed for production. Commodity markets are where producers and consumers of these raw materials can buy and sell them in a transparent and efficient manner.

Overall, financial markets are critical components of the global economy. They provide liquidity, facilitate investment, and allow individuals and businesses to manage risk. By understanding the various financial markets and their functions, investors can make informed decisions and achieve their financial goals.

Trading Instruments

Trading instruments are the different types of financial assets that traders and investors buy and sell in the financial markets to achieve their financial goals. These instruments are classified into various categories, with some being more popular than others. The most common trading instruments include equities, bonds, derivatives, futures, and options.

Equities

Equities, also known as stocks, are ownership shares in a company. When an investor buys a stock, they become a shareholder in that company and have a claim on a portion of its assets and earnings. The value of a stock is determined by the company’s performance, market demand, and other factors. Equities are a popular trading instrument because they offer the potential for high returns, but they also carry a high level of risk.

Bonds

Bonds are debt securities issued by companies or governments to raise capital. When an investor buys a bond, they are essentially lending money to the issuer and receiving interest payments in return. The value of a bond is determined by interest rates, credit ratings, and other factors. Bonds are a popular trading instrument because they offer a steady stream of income and are generally considered less risky than equities.

Derivatives

Derivatives are financial contracts that derive their value from an underlying asset, such as a stock, bond, or commodity. Examples of derivatives include options, futures, and swaps. Derivatives are a popular trading instrument because they offer the potential for high returns and can be used to hedge against market risks. However, they also carry a high level of risk and require a deep understanding of the underlying asset and market conditions.

Futures and Options

Futures and options are contracts that allow traders to buy or sell an underlying asset at a predetermined price and date. Futures contracts are binding agreements to buy or sell an asset at a future date, while options contracts give traders the right, but not the obligation, to buy or sell an asset at a future date. Futures and options are popular trading instruments because they offer the potential for high returns and can be used to hedge against market risks. However, they also carry a high level of risk and require a deep understanding of the underlying asset and market conditions.

In conclusion, trading instruments are an essential part of the financial markets, providing traders and investors with a range of options to achieve their financial goals. Each trading instrument has its own unique characteristics, advantages, and risks, and traders must carefully consider these factors before making any investment decisions.

Trading Strategies

Successful trading requires a well-planned strategy that takes into account the trader’s goals, risk tolerance, and market conditions. Here are some commonly used trading strategies:

Day Trading

Day trading is a popular short-term trading strategy where traders buy and sell financial instruments within the same trading day. Day traders aim to profit from the price movements that occur during the day and close all their positions before the market closes. Day trading requires a lot of focus, discipline, and knowledge of market trends. It is not suitable for everyone due to its high-risk nature.

Swing Trading

Swing trading is a medium-term trading strategy where traders hold positions for a few days to a few weeks. Swing traders aim to profit from the price movements that occur during the up and down swings of the market. Swing trading requires a good understanding of technical analysis and market trends. It is less risky than day trading but still requires discipline and patience.

Position Trading

Position trading is a long-term trading strategy where traders hold positions for several months to several years. Position traders aim to profit from the long-term trends of the market and ignore the short-term fluctuations. Position trading requires a lot of patience, discipline, and a good understanding of fundamental analysis. It is less risky than day trading and swing trading but requires a long-term commitment.

Algorithmic Trading

Algorithmic trading is a computerized trading strategy where traders use algorithms to execute trades automatically. Algorithmic trading requires a lot of programming skills and a good understanding of market trends. It is suitable for traders who want to take advantage of the speed and accuracy of computerized trading and minimize human error. Algorithmic trading is becoming increasingly popular due to its efficiency and profitability.

In conclusion, choosing the right trading strategy depends on the trader’s goals, risk tolerance, and market conditions. Traders should carefully evaluate their options and choose a strategy that suits their needs and personality.

Risk Management

Trading is inherently risky, and traders must be able to manage risk effectively to be successful. Risk management involves identifying potential risks and taking steps to mitigate them. This section will cover some key risk management techniques that traders can use to minimize losses and protect their capital.

Understanding Risk

The first step in effective risk management is understanding the risks involved in trading. Traders should be aware of the potential risks associated with different types of assets, such as stocks, options, and futures. They should also be aware of the risks associated with different trading strategies, such as day trading, swing trading, and position trading.

One common risk management technique is to limit the amount of capital that is allocated to any single trade. This can help to minimize losses if a trade goes against the trader. Traders can also use stop loss orders to automatically close out a trade if it reaches a certain price level.

Diversification

Another key risk management technique is diversification. By spreading their capital across multiple assets and markets, traders can reduce their exposure to any single asset or market. This can help to minimize losses if one asset or market experiences a downturn.

Traders can diversify their portfolio by investing in a mix of stocks, bonds, commodities, and currencies. They can also diversify within each asset class by investing in different sectors or industries.

Stop Loss Orders

Stop loss orders are a common risk management tool that traders can use to limit their losses. A stop loss order is an order to sell a security when it reaches a certain price level. This can help to protect the trader from a sudden drop in the value of the security.

Traders can use different types of stop loss orders, such as market orders, limit orders, and trailing stop orders. Each type of stop loss order has its own advantages and disadvantages, and traders should choose the type that best fits their trading style and risk tolerance.

In conclusion, risk management is a critical component of successful trading. By understanding the risks involved in trading, diversifying their portfolio, and using stop loss orders, traders can minimize their losses and protect their capital.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics gathered from trading activity, such as price movement and volume. It is a trading tool employed to evaluate securities and attempt to forecast their future movement. Technical analysis involves studying charts and past market data to identify patterns and trends that can help traders make informed decisions.

Chart Patterns

Chart patterns are graphical representations of price movements of a security over a period of time. Technical analysts use chart patterns to identify potential buy and sell signals. Some of the commonly used chart patterns include head and shoulders, double tops and bottoms, triangles, and flags. By identifying these patterns, traders can make informed decisions about when to enter or exit a trade.

Technical Indicators

Technical indicators are mathematical calculations based on the price and/or volume of a security. They are used to identify potential buy and sell signals. Some of the commonly used technical indicators include moving averages, relative strength index (RSI), and stochastic oscillator. These indicators can help traders identify overbought or oversold conditions, as well as potential trend reversals.

Candlestick Patterns

Candlestick patterns are a type of chart pattern used in technical analysis to identify potential buy and sell signals. They are graphical representations of the price movements of a security over a period of time. Candlestick patterns provide information about the opening, closing, high, and low prices of a security during a given time period. Some of the commonly used candlestick patterns include doji, hammer, and shooting star. By identifying these patterns, traders can make informed decisions about when to enter or exit a trade.

In conclusion, technical analysis is an important tool used by traders to evaluate securities and attempt to forecast their future movement. By studying charts and past market data, traders can identify patterns and trends that can help them make informed decisions about when to enter or exit a trade. Chart patterns, technical indicators, and candlestick patterns are some of the tools used in technical analysis to identify potential buy and sell signals.

Fundamental Analysis

Fundamental analysis is a method used to evaluate the intrinsic value of a security. It involves examining the economic, financial, and other qualitative and quantitative factors that affect the security’s value. Fundamental analysis is an essential tool for traders and investors who want to make informed decisions about buying and selling securities.

Economic Indicators

Economic indicators are statistical measures that provide insight into the overall health of an economy. They include data such as GDP, inflation, and unemployment rates. Fundamental analysts use economic indicators to assess the strength of a company’s industry and the broader economy. For example, if the GDP is growing, it may indicate that the company’s industry is healthy and that the company is likely to perform well.

Earnings Reports

Earnings reports are financial statements that companies release to the public on a quarterly basis. They provide information about the company’s revenue, expenses, and earnings. Fundamental analysts use earnings reports to evaluate a company’s financial health and to predict future earnings. They look at metrics such as earnings per share (EPS), revenue growth, and profit margins to assess the company’s profitability.

Market Sentiment

Market sentiment refers to the overall attitude of investors toward a particular security or the market as a whole. Fundamental analysts use market sentiment to gauge the market’s expectations for a company’s future performance. For example, if investors are optimistic about a company’s prospects, they may bid up the price of its stock, even if the company’s financial metrics are not particularly strong.

In conclusion, fundamental analysis is a critical tool for traders and investors who want to make informed decisions about buying and selling securities. By examining economic indicators, earnings reports, and market sentiment, fundamental analysts can assess the intrinsic value of a security and make predictions about its future performance.

Trading Psychology

Trading psychology refers to the emotional and psychological factors that affect a trader’s decision-making, behavior, and performance in the financial markets. Successful traders understand the importance of managing their emotions, biases, and risk tolerance. In this section, we will discuss some of the key aspects of trading psychology.

Emotional Discipline

Emotional discipline is the ability to manage emotions such as fear, greed, and anxiety when trading. Successful traders are disciplined and have a plan in place before entering a trade. They stick to their plan and avoid making impulsive decisions based on emotions. One way to achieve emotional discipline is to use stop-loss orders to limit potential losses. This helps traders to avoid making emotional decisions when the market moves against them.

Trading Biases

Trading biases are the cognitive biases that affect decision-making when trading. These biases can lead to irrational decisions and poor performance. Common trading biases include confirmation bias, where traders seek out information that confirms their existing beliefs, and overconfidence bias, where traders overestimate their abilities and take on too much risk. Successful traders are aware of their biases and work to overcome them.

Risk Tolerance

Risk tolerance is the amount of risk that a trader is willing to take on when trading. It is important to have a clear understanding of risk tolerance before entering a trade. Traders should only take on as much risk as they can afford to lose. One way to manage risk is to use position sizing, which involves adjusting the size of a trade based on the level of risk. This helps to limit potential losses and manage risk effectively.

In conclusion, trading psychology is an important aspect of successful trading. Emotional discipline, trading biases, and risk tolerance are key factors that traders need to consider when making trading decisions. By understanding and managing these factors, traders can improve their performance and achieve their trading goals.

Regulatory Environment

When it comes to trading, understanding the regulatory environment is crucial. This section will cover the key areas of securities regulation, international trade laws, and tax implications that traders need to be aware of.

Securities Regulation

Securities regulation is the set of laws and regulations that govern the buying and selling of securities, such as stocks and bonds. The goal of securities regulation is to protect investors from fraud and ensure that the markets are fair and transparent.

In the United States, the Securities and Exchange Commission (SEC) is the primary regulator of the securities industry. The SEC oversees the registration of securities, requires companies to disclose information to the public, and enforces securities laws.

Traders should be aware of the various regulations that apply to their trading activities, such as the prohibition on insider trading and the requirement to register as a broker-dealer if they engage in certain activities.

International Trade Laws

International trade laws are the rules and regulations that govern the exchange of goods and services between countries. These laws can have a significant impact on traders, particularly those who engage in cross-border trading.

One key area of international trade law is trade agreements. These agreements, such as the North American Free Trade Agreement (NAFTA) and the Trans-Pacific Partnership (TPP), can reduce trade barriers and make it easier for traders to do business across borders.

Another important area of international trade law is sanctions. Governments may impose sanctions on certain countries or individuals, which can restrict trade and financial transactions. Traders should be aware of any sanctions that apply to their trading activities to avoid violating the law.

Tax Implications

Traders should also be aware of the tax implications of their trading activities. Depending on the jurisdiction, traders may be subject to capital gains tax on their profits. They may also be able to deduct certain expenses related to their trading activities, such as trading software and data fees.

Traders should consult with a tax professional to ensure that they are in compliance with all applicable tax laws and to take advantage of any available deductions.

In summary, traders must be aware of the regulatory environment that governs their trading activities, including securities regulation, international trade laws, and tax implications. By staying informed and compliant with these regulations, traders can minimize their legal risks and maximize their trading opportunities.

Trading Platforms and Tools

Brokerage Accounts

When it comes to trading, having the right brokerage account is essential. It’s important to choose a reputable and reliable brokerage that offers a user-friendly platform, competitive pricing, and a wide range of investment options. Some popular brokerage accounts include Fidelity, E*TRADE, Charles Schwab, and Merrill Edge.

Trading Software

Trading software plays a crucial role in executing trades and analyzing market trends. Traders often look for intuitive and feature-rich trading platforms that offer real-time data, customizable charts, and advanced order types. Notable trading software options include thinkorswim, Interactive Brokers’ Trader Workstation, and MetaTrader.

Market Data

Access to accurate and timely market data is vital for making informed trading decisions. Reliable market data sources provide information on stock prices, volume, bid-ask spreads, and other key metrics. Bloomberg Terminal is a widely used platform that offers comprehensive real-time market data and research tools for traders and investors.

Execution of Trades

Trading involves the buying and selling of financial instruments such as stocks, bonds, and currencies. The execution of trades is the process of fulfilling a buy or sell order. This section will discuss the different aspects of executing trades.

Order Types

Traders have different order types to choose from when executing trades. The most common order types are market orders, limit orders, and stop orders. A market order is an order to buy or sell a security at the current market price. A limit order is an order to buy or sell a security at a specified price or better. A stop order is an order to buy or sell a security when the price reaches a specified level.

Trade Execution

Once an order is placed, the trade execution process begins. The order is transmitted to the broker, who then routes it to the appropriate exchange or market maker. The broker’s responsibility is to execute the order at the best possible price. The execution can happen in real-time or be delayed depending on market conditions.

Clearing and Settlement

After the trade is executed, the clearing and settlement process begins. Clearing is the process of matching the buy and sell orders and ensuring that all parties have the necessary funds and securities to complete the transaction. Settlement is the process of transferring ownership of the security and funds between the buyer and seller. This process can take several days to complete.

In conclusion, executing trades involves choosing the appropriate order type, transmitting the order to the broker, and completing the clearing and settlement process. Traders should be aware of the different order types and understand the trade execution process to ensure that they get the best possible price for their trades.

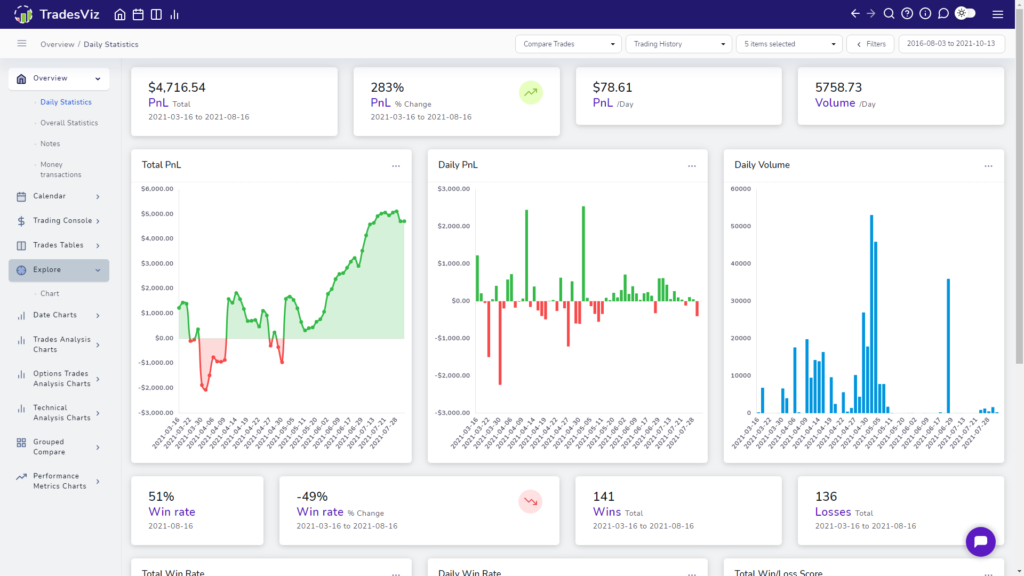

Performance Analysis

Performance analysis is a crucial aspect of trading. It involves evaluating the performance of a trader’s trading strategy, identifying strengths and weaknesses, and making necessary adjustments to improve performance. In this section, we will discuss three key areas of.

Frequently Asked Questions

What are the different types of trading strategies?

There are various types of trading strategies that traders use to execute trades in the market. Some of the common trading strategies include day trading, swing trading, position trading, and scalping. Each strategy has its own unique approach to trading and requires different levels of experience and risk tolerance. Day trading involves buying and selling securities within the same day, while swing trading involves holding positions for several days or weeks. Position trading involves holding positions for several months or years, while scalping involves taking advantage of small price movements in the market.

Which platforms are best for beginners to start trading?

For beginners, it is recommended to start with a platform that offers a user-friendly interface, educational resources, and a demo account to practice trading without risking real money. Some popular trading platforms for beginners include E*TRADE, TD Ameritrade, and Robinhood. These platforms offer a range of features and tools to help beginners learn how to trade and make informed decisions.

What are the essential tools for analyzing trading charts?

Analyzing trading charts is an essential part of trading. Some of the essential tools for analyzing trading charts include moving averages, trend lines, support and resistance levels, and technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help traders identify trends, momentum, and potential entry and exit points for trades.

How can one effectively manage risk in trading?

Managing risk is crucial for successful trading. One effective way to manage risk is to use stop-loss orders, which automatically close a trade when the price reaches a predetermined level. Traders should also have a risk management plan in place, which includes setting a maximum loss per trade and per day. It is also important to diversify your portfolio and not put all your eggs in one basket.

What are the key indicators to watch when trading stocks?

When trading stocks, there are several key indicators to watch, including earnings reports, news events, and technical indicators such as moving averages, support and resistance levels, and volume. Earnings reports can have a significant impact on a stock’s price, while news events such as mergers and acquisitions can also affect a stock’s price. Technical indicators can help traders identify trends and potential entry and exit points for trades.

What books are recommended for enhancing trading knowledge?

There are many books available that can help traders enhance their trading knowledge. Some popular books include “Trading in the Zone” by Mark Douglas, “The Intelligent Investor” by Benjamin Graham, and “Technical Analysis of the Financial Markets” by John J. Murphy. These books cover a range of topics, including trading psychology, fundamental analysis, and technical analysis.

| RépondreTransférer Ajouter une réaction |

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.