Non-fungible tokens, or NFTs, are a kind of digital asset that are becoming more and more well-liked in the fields of collectibles, music, and art. Because NFTs are one-of-a-kind and cannot be duplicated, they are an invaluable resource for both makers and collectors. Blockchain technology underpins NFTs, guaranteeing their ownership and legitimacy.

Online markets are used for the purchasing and selling of NFTs, providing collectors with the opportunity to bid on and acquire unique digital assets. Even while some NFTs have sold for millions of dollars, collectors can also choose from more reasonably priced versions. When purchasing and selling NFTs, nevertheless, legal and moral issues need to be taken into mind because copyright infringement and ownership conflicts are potential issues.

Key Takeaways

- NFTs are a type of digital asset that are unique and cannot be replicated.

- NFTs are based on blockchain technology, which ensures their authenticity and ownership.

- While NFTs can be bought and sold through online marketplaces, legal and ethical considerations must be taken into account.

What Are NFTs

Definition and Origin

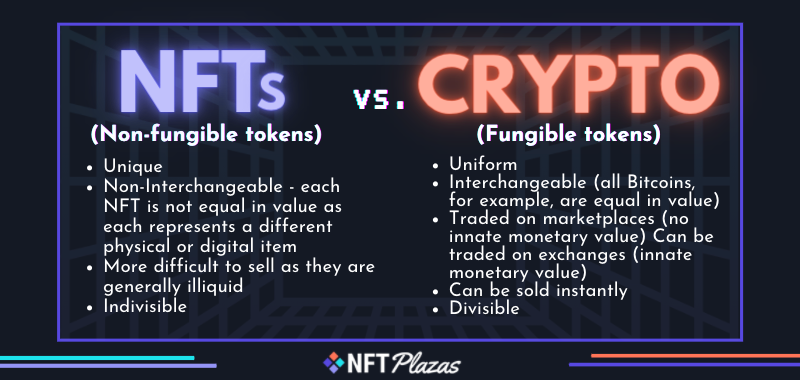

The acronym for Non-Fungible Token is NFT. It is a particular kind of digital asset that is irreplaceable and cannot be traded in for another item of comparable worth. 2014 saw the creation of the first NFT on the Ethereum network.

They were first used to symbolize digital art, but over time, they have come to represent other kinds of digital assets as well, such tweets, videos, and music.

How NFTs Work

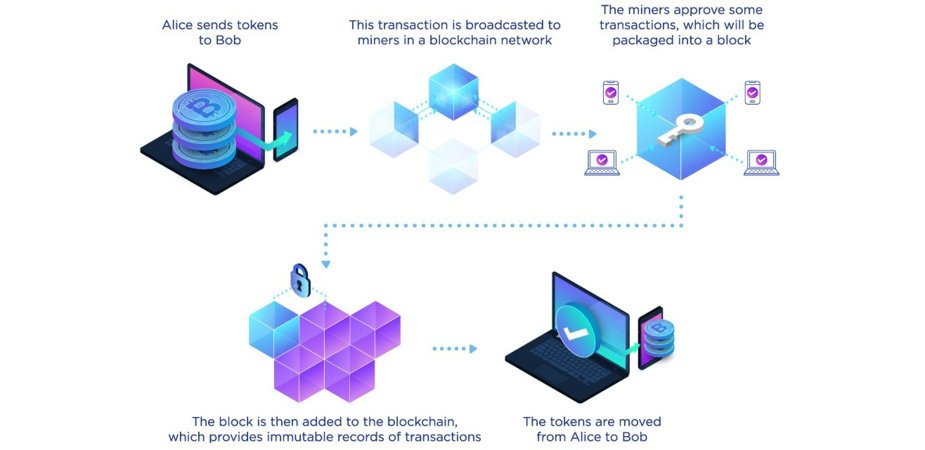

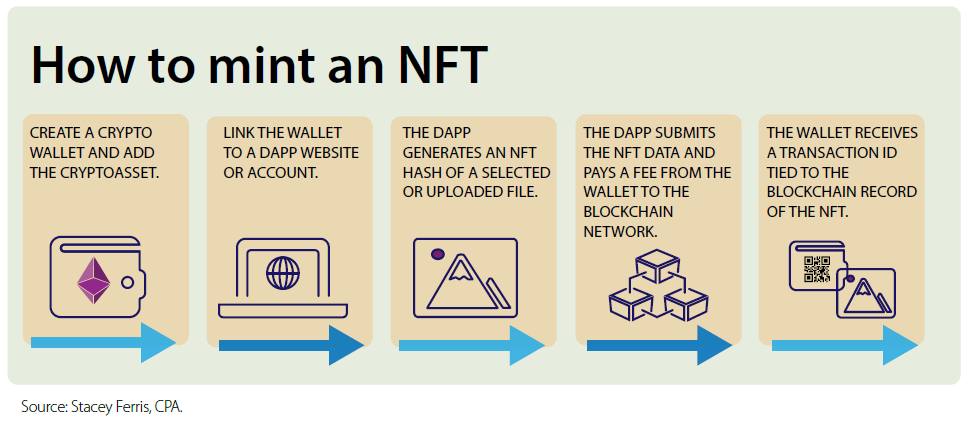

Blockchain technology, the same technology behind cryptocurrencies like Ethereum and Bitcoin, is utilized to build NFTs. A blockchain is used to hold the individual digital assets that make up each NFT. The ownership and transaction history of the NFT are documented in a ledger-like fashion via the blockchain.

The ownership rights to a certain digital item are purchased when an NFT is purchased. Since the ownership rights are stored on the blockchain, it is simple to confirm the identity of the NFT’s owner and transaction history.

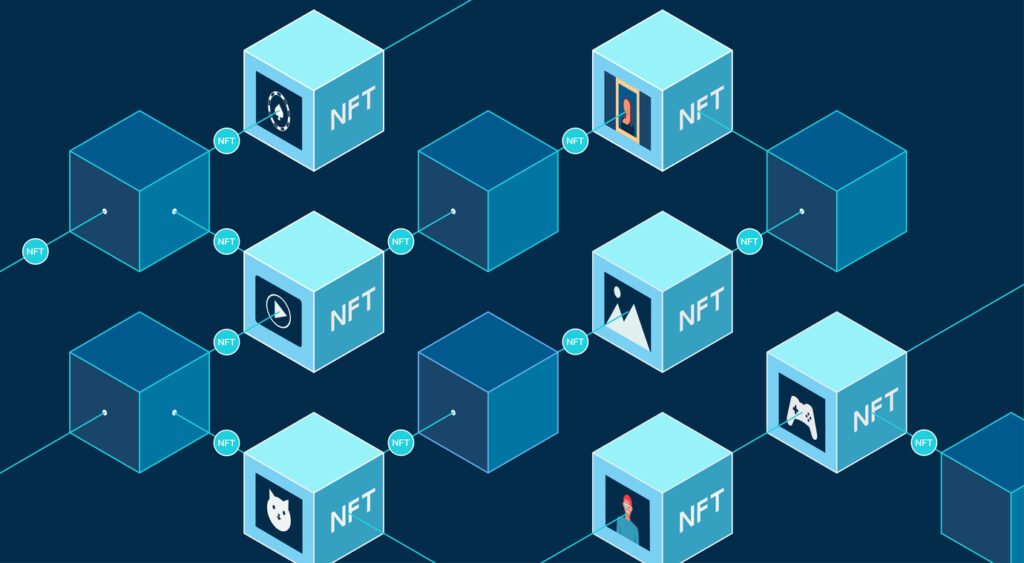

Types of NFTs

There are several types of NFTs, including:

- Art NFTs: These are digital art pieces that are unique and cannot be replicated.

- Music NFTs: These are digital music files that are unique and cannot be replicated.

- Video NFTs: These are unique video files that are stored on the blockchain.

- Virtual Real Estate NFTs: These are virtual plots of land or buildings that are unique and cannot be replicated.

In recent years, NFTs have grown in popularity; some have been sold for millions of dollars. NFTs are controversial, though, and there is debate over them as well as issues with fraud and environmental effects.

The Technology Behind NFTs

On a blockchain, NFTs are distinct digital assets that are kept safe. NFT technology is founded on the same ideas as cryptocurrency technology. NFTs, on the other hand, cannot be exchanged for cryptocurrency. Every NFT is distinct and stands for a particular asset, whether a tweet, a piece of digital art, or music.

Blockchain Fundamentals

A decentralized digital ledger called the blockchain keeps track of transactions made on a network of computers. Every block in the chain has transaction data, a timestamp, and a cryptographic hash of the block before it. A blockchain is resistant to data alteration by design. Without the network’s approval, data cannot be altered once it has been recorded.

Smart Contracts and Token Standards

The terms of the agreement between the buyer and seller are immediately incorporated into lines of code to create self-executing contracts known as smart contracts. They operate on the blockchain and start working automatically when specific requirements are satisfied.

The ownership and transfer rights of NFTs are managed by smart contracts. A smart contract is implemented on the blockchain to define the ownership and transfer rights of an NFT at the time of creation.

The most widely used token standard for NFTs is ERC-721. The standard for non-fungible tokens (NFTs) on the Ethereum blockchain outlines a set of guidelines for their creation. Tokens derived by ERC-721 are distinct, non-transferable, and indivisible. A distinct item, whether a work of digital art, a piece of music, or a tweet, is represented by each token.

Interoperability and Metadata

One important aspect of NFTs is interoperability. The ability to move NFTs across various blockchains and platforms promotes increased interoperability and flexibility. Metadata, or additional information associated to the NFT, is used to do this. Information about the object, such as the creator, the title, and the creation date, can be included in the metadata. In addition, details about the token, including its kind, ID, and standard, may be included.

To sum up, smart contracts, token standards, and the blockchain form the foundation of NFT technology. NFTs are distinct digital assets that are kept on the blockchain and stand in for particular kinds of digital assets, like tweets, songs, or works of art. NFTs’ primary characteristics that enable more flexibility and interoperability are metadata and interoperability.

Buying and Selling NFTs

NFT Marketplaces

NFT markets are virtual marketplaces where NFTs can be exchanged between buyers and sellers. OpenSea is the biggest NFT marketplace where users may build, explore, purchase, sell, and auction NFTs with bitcoin. Nifty Gateway, SuperRare, and Rarible are a few more well-known marketplaces. Prior to selecting a marketplace, it’s crucial to conduct research and make comparisons as each one has distinct features, costs, and communities.

Auction and Fixed Price Sales

NFTs may be offered for sale at auction or at a set price. Buyers can place bids on NFTs at auctions, with the item being won by the highest bidder. On the other hand, sellers can determine a precise price for their NFT in fixed price sales. Each approach has advantages and disadvantages, and the seller must determine which is ideal for their NFT. It’s crucial to remember that marketplaces could impose various fees on various kinds of sales.

Wallets and Transactions

Users must have a cryptocurrency wallet that works with the NFT marketplace they are using in order to buy or sell NFTs. Wallets like MetaMask, Coinbase Wallet, and Trust Wallet are widely used. Ethereum is the most common cryptocurrency used for transactions in NFT marketplaces, though other cryptocurrencies might be accepted as well. It’s critical to comprehend the fees related to each transaction and to validate all transaction information one last time before relying on them.

Use Cases for NFTs

Recent years have seen a rise in the use of NFTs because of their special qualities, which make them versatile. The following are a few of the most well-known NFT usage cases:

Digital Art and Collectibles

Digitized art and collectibles are among the most well-known industries where NFTs are used. Artists can use NFTs to market and validate their digital works as one-of-a-kind, original works of art. The ability to now monetarily monetise their work in previously unattainable ways has created a new market for digital artists. Virtual goods in video games or trading cards are examples of digital collectibles that can be made with NFTs.

Gaming and Virtual Goods

Moreover, NFTs are being employed in the gaming sector to produce one-of-a-kind, distinctive virtual goods that may be exchanged, purchased, and sold. Instead of only renting them from game publishers, this enables players to actually own their virtual goods. Moreover, NFTs can be used to develop in-game economies in which users can accumulate virtual currency and spend it on in-game goods.

Real Estate and Tokenization

Real estate and tokenization provide a further use for NFTs. Physical assets like real estate or artwork might have their ownership represented by NFTs. This makes it possible for numerous persons to hold a portion of a physical asset via fractional ownership.

Additionally, assets can be tokenized with NFTs to enable trading on blockchain-based markets.

NFTs can be used for a variety of purposes, including real estate, gaming, digital art, and collectibles. There will probably be more applications for NFTs in the future as the technology develops.

Legal and Ethical Considerations

Although NFTs have been incredibly popular lately, there are legal and moral issues that must be taken into account with their growth. We will cover some of the most significant NFT-related topics in this area.

Copyright and Ownership Issues

One of the most significant legal considerations when it comes to NFTs is copyright and ownership. NFTs are essentially digital assets that can be bought and sold, but they are not necessarily accompanied by the underlying intellectual property rights. Therefore, it is essential to ensure that the creator of the NFT is the rightful owner of the underlying asset.

According to Jones Day, the intellectual property rights granted to the owner of an NFT include the right to use, copy, display, and modify the content. However, it is important to note that the ownership of the content itself does not transfer with the sale of the NFT unless explicitly stated in the contract.

Environmental Impact

Another ethical consideration when it comes to NFTs is their environmental impact. NFTs are created and stored on the blockchain, which is an energy-intensive process. This has led to concerns about the carbon footprint of NFTs and their impact on the environment.

According to an article by The Guardian, the energy consumption of the Bitcoin network alone is equivalent to that of the entire country of Argentina. While NFTs are not solely responsible for this energy consumption, they do contribute to it. As a result, some artists and creators are choosing to avoid NFTs altogether to reduce their carbon footprint.

Regulatory Landscape

The regulatory environment that surrounds NFTs is continually changing. NFTs are not yet governed by any particular laws, and in many places, it is still unclear what the legal standing of NFTs is. Nevertheless, NFT producers and purchasers should be aware of a few legal issues.

According to The National Law Review, an NFT can be subject to U.S. securities law if it has security-like features or otherwise meets the Howey test. This test determines whether a particular transaction qualifies as an investment contract and is therefore subject to securities regulations. Additionally, there may be tax implications associated with the sale of NFTs, which should be considered before engaging in any transactions.

In conclusion, NFTs have ushered in a new era of digital ownership and investment, but there are moral and legal issues that must be taken into account. Concerns like ownership and copyright, the environment, and regulations are just a few of the things that need to be taken into account while working with NFTs.

Investing in NFTs

Non-fungible tokens, or NFTs, have gained popularity recently as more investors try to profit from this emerging asset class. Even though NFT investments might be profitable, it’s crucial to think about risk considerations, portfolio diversification, and market analysis before making any selections.

Market Analysis

Prior to making an investment in NFTs, like with any other, it is crucial to perform a comprehensive market analysis. This entails investigating the market’s overall development potential as well as the demand for certain kinds of NFTs and existing market trends. Along with the reputation of the NFT founders, investors ought to take the legitimacy of the NFT platform into account.

Risk Factors

Investors should be aware of the unique risks associated with investing in NFTs. These hazards include the possibility of fraudulent NFTs, market turbulence, and the absence of industry regulation.

Before making any investment decisions, it is crucial for investors to perform due diligence and study the NFT platform and founders. Furthermore, given the short-term volatility of the market, investors should be ready to hang onto their NFTs for a longer time.

Portfolio Diversification

It is advisable to combine NFT investing with a portfolio that is well-diversified. Rather than constituting the bulk of an investor’s portfolio, NFTs ought to be seen as an auxiliary asset class. Investors can reduce risk and possibly boost overall profits by diversifying their holdings.

In conclusion,

buying NFTs can be a profitable venture for investors; however, it’s critical to diversify one’s portfolio, do a careful research of the market, and take risk factors into account. Investors should approach NFTs cautiously and be ready for any possible dangers, just like with any other investment.

Future of NFTs

NFTs have been more and more well-liked in the last several years, and a lot of analysts think that this trend will continue. These are some new developments in technology, upcoming trends, and possible uses for NFTs.

Emerging Trends

Using value-added drops is one of the new trends in NFTs. Manufacturers of NFTs are seeing the need for value-added drops, which will lead to a wealth of future uses and new applications for NFTs. However, worthless NFT collections would plummet and eventually disappear from the market.

The usage of NFTs in gaming, music, fashion, and other multibillion dollar sectors is another trend. These sectors are currently adopting this technology, and analysts predict that NFTs will continue to find greater use in these sectors in the future.

Technological Advancements

The future of this market is anticipated to be significantly shaped by technological developments in NFTs. NFTs with blockchain technology integration is one of the most noteworthy developments. Blockchain technology is globally accessible, decentralized, essentially safe, and built for wealth creation and individual empowerment. An important benefit for NFTs is its inherent resistance to fraud and censorship.

Smart contract technology is another development in technology. The terms of the agreement between the buyer and seller are immediately incorporated into lines of code to create self-executing contracts known as smart contracts. They make it possible to create programmable NFTs, which have a wide range of uses.

Potential Applications

NFTs have a wide range of possible uses. The field of art is one such use. Digital art can be represented by NFTs and then traded and sold just like conventional art. This gives collectors another avenue to invest in art and opens up a new market for digital artists.

The real estate sector is one more possible application. Transactions can be made simpler and more secure by using NFTs to represent real estate property ownership. The buying and selling of real estate may be completely changed by this.

All things considered, NFTs have a bright future ahead of them thanks to new developments in technology, growing trends, and possible uses.

Some important questions about NFTs include:

1. What is the purpose and potential of NFTs?

2. How do NFTs work and what makes them unique?

3. What are the legal and copyright implications of NFTs?

4. How do NFTs impact the art and entertainment industries?

5. What are the environmental concerns related to NFTs?

6. What are the risks and challenges associated with investing in NFTs?

7. How are NFTs regulated and what are the implications for taxation?

8. What are the future trends and developments in the NFT space?

9. How do NFTs relate to blockchain technology and cryptocurrency?

10. What are the ethical considerations surrounding NFTs?

Here are some brief responses to each question:

1. The purpose and potential of NFTs include creating unique digital assets, enabling ownership and provenance of digital content, and providing new opportunities for creators and collectors.

2. NFTs work by using blockchain technology to create a digital certificate of ownership for a specific digital item, making it unique and verifiable.

3. The legal and copyright implications of NFTs involve issues such as intellectual property rights, licensing, and ownership rights for digital content.

4. NFTs impact the art and entertainment industries by offering new ways for artists, musicians, and creators to monetize and distribute their work.

5. Environmental concerns related to NFTs arise from the energy consumption of blockchain networks used for NFT transactions.

6. Risks and challenges associated with investing in NFTs include market volatility, potential for fraud, and the speculative nature of NFT valuations.

7. NFTs are currently subject to evolving regulations and taxation policies, which may vary by jurisdiction.

8. Future trends and developments in the NFT space may include increased integration with virtual reality, gaming, and other digital experiences.

9. NFTs are closely related to blockchain technology and cryptocurrency, as they leverage the underlying infrastructure for digital ownership and transactions.

10. Ethical considerations surrounding NFTs include issues of inclusivity, sustainability, and the impact on traditional art markets and creators.

For more in-depth information, it’s recommended to consult specialized resources or professionals in the field of NFTs.

I’d be happy to help with that. Here’s an article about NFTs and what makes them valuable:

Title: Understanding the Expensive World of NFTs

Non-fungible tokens (NFTs) have taken the digital world by storm, captivating the attention of artists, collectors, and investors alike. These unique digital assets have garnered significant attention for their often staggering price tags, prompting many to wonder what makes them so expensive.

At their core, NFTs are digital tokens that represent ownership or proof of authenticity of a specific item or piece of content, such as art, music, videos, or other digital assets. What sets NFTs apart from traditional cryptocurrencies like Bitcoin or Ethereum is their non-fungibility, meaning each token is distinct and cannot be exchanged on a one-to-one basis like traditional currency. This uniqueness is a key factor in understanding why NFTs can command such high prices.

One of the primary drivers of the high value of NFTs is the concept of scarcity. Many NFTs are part of limited editions or are entirely unique, creating a sense of exclusivity that drives up demand and, consequently, prices. This scarcity factor is often amplified by the reputation and popularity of the creator or artist behind the NFT, as well as the cultural or historical significance of the digital content itself.

Additionally, the blockchain technology that underpins NFTs plays a crucial role in their perceived value. Blockchain provides a secure and transparent ledger of ownership, ensuring that the provenance and authenticity of an NFT can be easily verified. This trust and transparency in the ownership of digital assets contribute to the perceived value of NFTs in the eyes of collectors and investors.

Furthermore, the burgeoning market for NFTs has seen a convergence of art, technology, and finance, attracting a diverse range of participants who are willing to pay a premium for ownership of digital assets. The intersection of these different industries has contributed to the perception of NFTs as both a status symbol and a potentially lucrative investment opportunity, further driving up their prices.

It’s important to note that the valuation of NFTs is also influenced by speculative factors, market trends, and the willingness of buyers to assign significant value to digital assets. The nascent and rapidly evolving nature of the NFT market means that valuations can be subject to significant volatility and speculation, leading to the perception of inflated prices for certain NFTs.