Economic inflation is a term that is often used in discussions about the economy, but it can be difficult to understand what it means and how it affects people’s lives. In simple terms, inflation is the rate at which prices for goods and services increase over time. When inflation is high, the purchasing power of money decreases, meaning that people can buy less with the same amount of money.

There are many factors that can cause inflation, including increases in the cost of production, changes in the supply and demand for goods and services, and government policies such as changes in interest rates or taxes. Inflation can also vary depending on the country and the state of its economy. For example, developing countries may experience higher rates of inflation than developed countries due to factors such as political instability, weak institutions, and currency devaluation.

Key Takeaways

- Inflation is the rate at which prices for goods and services increase over time, leading to a decrease in the purchasing power of money.

- Inflation can be caused by a variety of factors, including changes in the cost of production, supply and demand, and government policies.

- Inflation can vary depending on the country and the state of its economy, with developing countries often experiencing higher rates of inflation than developed countries.

Definition of Economic Inflation

Inflation is a macroeconomic phenomenon that occurs when the general price level of goods and services in an economy rises over time. It means that the purchasing power of money decreases as the prices of goods and services increase. Inflation is measured by the inflation rate, which is the percentage change in the price level over a period of time, usually a year.

The causes of inflation can be categorized into two types: demand-pull inflation and cost-push inflation. Demand-pull inflation occurs when the demand for goods and services exceeds the supply, leading to an increase in prices. Cost-push inflation occurs when the cost of producing goods and services increases, leading to an increase in prices.

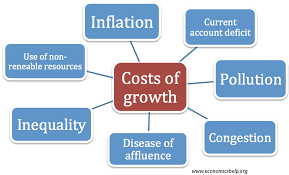

Inflation has both positive and negative effects on the economy. On the positive side, moderate inflation can stimulate economic growth by encouraging investment and consumption. On the negative side, high inflation can lead to a decrease in the value of money, which can reduce economic growth and lead to social and political instability.

Overall, inflation is a complex economic phenomenon that requires careful monitoring and management by policymakers to ensure that it remains at a moderate level that is conducive to sustainable economic growth.

Causes of Inflation

Inflation is the general increase in prices of goods and services in an economy over a period of time. There are several factors that contribute to inflation, and understanding these factors is crucial in formulating policies to control inflation.

Demand-Pull Inflation

Demand-pull inflation occurs when the aggregate demand for goods and services in an economy exceeds the aggregate supply. This is often caused by an increase in consumer spending, a rise in government spending, or an increase in exports. When the demand for goods and services is high, producers tend to raise their prices to maximize profits, leading to an increase in the general price level.

Cost-Push Inflation

Cost-push inflation occurs when the cost of production increases, leading to an increase in the prices of goods and services. This can be caused by several factors, including an increase in the cost of raw materials, an increase in wages, or an increase in taxes. When the cost of production increases, producers may raise their prices to maintain their profit margins, leading to an increase in the general price level.

Built-In Inflation

Built-in inflation, also known as wage-push inflation, occurs when workers demand higher wages to keep up with the general increase in prices of goods and services. This leads to an increase in the cost of production, which in turn leads to an increase in prices. This cycle can be difficult to break, as higher wages lead to higher prices, which in turn lead to a demand for even higher wages.

In conclusion, inflation is a complex phenomenon that can be caused by several factors. Understanding the causes of inflation is crucial in formulating policies to control inflation and maintain a stable economy.

Measurement of Inflation

Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Inflation is measured by calculating the percentage change in the price level of a basket of goods and services over a period of time. There are various methods to measure inflation, but the most common ones are Consumer Price Index (CPI), Producer Price Index (PPI), and Gross Domestic Product (GDP) Deflator.

Consumer Price Index (CPI)

The CPI, produced by the Bureau of Labor Statistics (BLS), is the most widely used measure of inflation. The primary CPI (CPI-U) is designed to measure price changes faced by urban consumers. It is calculated by measuring the price changes of a basket of goods and services that a typical consumer purchases. The basket includes various goods and services such as food, housing, clothing, transportation, medical care, and recreation. The CPI is used to adjust income payments, tax brackets, and other economic indicators for inflation.

Producer Price Index (PPI)

The PPI measures the average change in prices that domestic producers receive for their output. It is calculated by measuring the price changes of a basket of goods and services at various stages of production, from raw materials to finished goods. The PPI is used to measure the inflation rate at the wholesale level and is considered a leading indicator of inflation.

Gross Domestic Product (GDP) Deflator

The GDP deflator is a measure of inflation that reflects the price changes of all goods and services produced in an economy. It is calculated by dividing the nominal GDP by the real GDP and multiplying the result by 100. The GDP deflator is used to measure the inflation rate of an economy and is considered a broader measure of inflation than the CPI or PPI.

In conclusion, measuring inflation is crucial for policymakers and investors to make informed decisions. The CPI, PPI, and GDP deflator are the most commonly used methods to measure inflation. Each method has its strengths and weaknesses, and policymakers use a combination of these methods to get a comprehensive view of the inflation rate.

Effects of Inflation

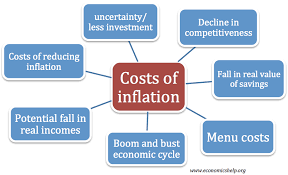

Inflation refers to a sustained increase in the general price level of goods and services in an economy. While inflation is a normal part of a healthy economy, it can have a number of negative effects on individuals, businesses, and the economy as a whole. This section will explore some of the most common effects of inflation.

On Purchasing Power

One of the most obvious effects of inflation is that it reduces the purchasing power of money. As the general price level of goods and services increases, each unit of currency buys fewer goods and services than it did before. This can have a significant impact on individuals and households, particularly those on fixed incomes or with limited financial resources.

For example, if inflation were to increase the price of groceries by 10%, a household with a fixed income of $50,000 per year would effectively lose $5,000 in purchasing power. This can lead to reduced consumption, lower living standards, and increased financial stress for households.

On Investment

Inflation can also have a significant impact on investment. Inflation erodes the real value of investment returns, particularly those from fixed-income investments such as bonds. As the general price level increases, the fixed returns from these investments become less valuable in real terms. This can lead to reduced investment returns, lower savings rates, and increased financial risk for investors.

On the other hand, inflation can benefit investments in certain assets such as real estate or stocks. These assets tend to appreciate in value over time, and inflation can increase their value even further. However, it is important to note that this effect is not universal and can depend on a number of factors, including the specific asset, the rate of inflation, and the overall state of the economy.

On Savings

Inflation can also have an impact on savings. As the general price level increases, the real value of savings decreases. This can be particularly problematic for individuals and households who rely on savings to fund future expenses such as education, healthcare, or retirement. Inflation can reduce the purchasing power of these savings, making it more difficult to meet these expenses in the future.

In addition, inflation can lead to increased uncertainty and risk in financial markets. This can make it more difficult for individuals and businesses to plan for the future, and can lead to increased volatility and instability in the economy as a whole.

Inflation and Government Policy

Inflation is a complex economic phenomenon that can be influenced by various factors, including government policies. Two primary tools that governments use to control inflation are monetary policy and fiscal policy.

Monetary Policy

Monetary policy refers to the actions taken by a central bank to control the supply and cost of money in an economy. Central banks can influence inflation by adjusting interest rates, controlling the money supply, and using other monetary tools.

For example, if inflation is rising, a central bank may increase interest rates to reduce the amount of money in circulation. This can help to slow down economic growth and reduce demand for goods and services, which can help to lower inflation.

Fiscal Policy

Fiscal policy refers to the actions taken by a government to control its spending and taxation policies. Governments can use fiscal policy to influence inflation by adjusting their spending levels and tax rates.

If inflation is rising, a government may reduce its spending to reduce demand for goods and services. Alternatively, a government may increase taxes to reduce the amount of money in circulation and help to slow down economic growth.

Overall, while government policies can play a role in controlling inflation, it is important to note that inflation is a complex economic phenomenon that can be influenced by a wide range of factors. Therefore, it is important for governments to work closely with economists and other experts to develop effective policies that can help to manage inflation and promote sustainable economic growth.

Hyperinflation: An Extreme Case

Hyperinflation is a rare but devastating economic phenomenon characterized by extremely high and accelerating inflation rates. It occurs when the supply of money in an economy increases rapidly, without a corresponding increase in the supply of goods and services. This leads to a sharp and rapid increase in prices, and a loss of confidence in the local currency.

One of the most extreme cases of hyperinflation occurred in the Weimar Republic in Germany in the early 1920s. The German government had borrowed heavily to finance its involvement in World War I, and after the war ended, it continued to print money to repay its debts. As a result, the value of the German mark plummeted, and prices for goods and services skyrocketed.

At the height of the hyperinflation, prices were doubling every few days, and people were paid in wheelbarrows full of cash. In November 1923, the exchange rate of the German mark to the US dollar was 4.2 trillion to one. The hyperinflation had devastating effects on the German economy and society, leading to widespread poverty, social unrest, and political instability.

Hyperinflation can have a range of causes, including war, political instability, and economic mismanagement. It is often accompanied by a loss of confidence in the government and the local currency, and people may turn to alternative currencies or goods to store their wealth. In extreme cases, hyperinflation can lead to the collapse of an economy and the loss of people’s life savings.

While hyperinflation is a rare occurrence, it serves as a cautionary tale for governments and central banks to manage their economies and monetary policies carefully. By maintaining stable inflation rates and avoiding excessive money printing, economies can avoid the devastating effects of hyperinflation.

Inflation Targeting

Inflation targeting is a monetary policy framework that involves setting a specific target for the rate of inflation and using monetary policy tools to achieve that target. The goal of inflation targeting is to achieve price stability, which is generally defined as a low and stable rate of inflation.

Central banks around the world use inflation targeting as a way to manage inflation and maintain economic stability. Inflation targeting typically involves setting a target inflation rate, which is usually around 2%, and using monetary policy tools such as interest rates to achieve that target.

One of the benefits of inflation targeting is that it provides a clear framework for monetary policy decision-making. By setting a specific target for inflation, central banks can communicate their policy goals more effectively to the public and financial markets. This can help to anchor inflation expectations and reduce uncertainty about future inflation rates.

Another benefit of inflation targeting is that it can help to reduce the risk of inflation spiraling out of control. By setting a target for inflation and using monetary policy tools to achieve that target, central banks can prevent inflation from becoming too high or too low. This can help to maintain economic stability and promote long-term economic growth.

Overall, inflation targeting is a widely used monetary policy framework that has been shown to be effective in achieving price stability and maintaining economic stability. By setting a specific target for inflation and using monetary policy tools to achieve that target, central banks can help to promote long-term economic growth and reduce the risk of inflation spiraling out of control.

Inflation in Developing vs. Developed Countries

Inflation is a phenomenon that affects economies across the globe. However, the impact of inflation on developing and developed countries is different. Developed countries have more stable and established economies, while developing countries are still in the process of building their economies. As a result, inflation in developing countries tends to be more volatile and unpredictable than in developed countries.

One of the reasons for this difference is that developing countries often have weaker institutions and less effective policy frameworks to control inflation. Inflation can be caused by a variety of factors, such as excessive money supply, high demand for goods and services, and supply-side shocks. Developing countries may struggle to manage these factors effectively, leading to higher inflation rates.

Another factor that contributes to the difference in inflation rates between developing and developed countries is the level of economic development. Developed countries tend to have more diversified and mature economies, which are less susceptible to inflationary pressures. In contrast, developing countries often have less diversified economies, which can make them more vulnerable to inflation.

Moreover, developed countries have access to more sophisticated financial instruments, which can help them manage inflation more effectively. For example, developed countries can issue inflation-indexed bonds, which provide investors with a return that is adjusted for inflation. This helps to reduce the risk of inflation eroding the value of investments.

In summary, inflation in developing countries tends to be more volatile and unpredictable than in developed countries due to weaker institutions, less effective policy frameworks, less diversified economies, and limited access to sophisticated financial instruments.

Historical Instances of Inflation

Inflation has been a recurring phenomenon throughout history, affecting economies across the globe. In the United States, the most notable episodes of inflation occurred during the 1970s and early 1980s and again in the 21st century.

During the 1970s, inflation rose rapidly due to a combination of factors, including the Vietnam War, the oil crisis, and expansionary monetary policies. In 1979, inflation reached a peak of 13.3%, the highest rate since World War II. The Federal Reserve responded by tightening monetary policy, which ultimately led to a recession in the early 1980s.

In the 21st century, inflation has been relatively low and stable, but there have been some notable episodes of inflation. For example, the inflation rate rose to 5.4% in July 2008 due to rising energy and food prices. This was the highest rate of inflation since 1991. The Federal Reserve responded by raising interest rates, which helped to bring inflation back down to more manageable levels.

Other countries have also experienced episodes of high inflation. For example, in the 1920s, Germany experienced hyperinflation, with prices rising by over 20% per day at one point. This was caused by the government’s decision to print money to pay for war reparations. The hyperinflation ultimately led to the collapse of the German economy and the rise of the Nazi party.

In Latin America, many countries have experienced high inflation rates due to political instability and weak economic policies. For example, in the 1980s, Brazil experienced hyperinflation, with prices rising by over 100% per month at one point. The government responded by introducing a new currency and implementing strict monetary policies.

In summary, inflation has been a recurring phenomenon throughout history, affecting economies across the globe. The causes of inflation are complex and multifaceted, and the appropriate policy response depends on the specific circumstances of each episode.

Frequently Asked Questions

What factors contribute to the rise in inflation rates?

Inflation rates rise due to various factors such as an increase in demand for goods and services, a decrease in the supply of goods and services, and an increase in the cost of production. The increase in demand for goods and services can be due to an increase in population, an increase in consumer spending, or an increase in government spending. The decrease in supply of goods and services can be due to natural disasters, trade restrictions, or a decrease in production. The increase in the cost of production can be due to an increase in the cost of raw materials, an increase in labor costs, or an increase in taxes.

How is inflation measured and reported?

Inflation is measured using various indexes such as the Consumer Price Index (CPI), Producer Price Index (PPI), and Gross Domestic Product (GDP) deflator. The CPI measures the change in the price of a basket of goods and services purchased by households. The PPI measures the change in the price of goods and services purchased by producers. The GDP deflator measures the change in the price of all goods and services produced in an economy. Inflation is reported on a monthly and annual basis by government agencies such as the Bureau of Labor Statistics.

What are the impacts of inflation on purchasing power?

Inflation reduces the purchasing power of money. This means that the same amount of money can buy fewer goods and services than before. Inflation can lead to an increase in the cost of living, which can reduce the standard of living for people on fixed incomes or with low wages. Inflation can also lead to a decrease in savings and investment returns, as the value of money decreases over time.

How does inflation influence interest rates and investments?

Inflation influences interest rates and investments by affecting the supply and demand for money. As inflation increases, the demand for money decreases, and the supply of money increases. This leads to a decrease in the value of money and an increase in interest rates. High inflation rates can lead to a decrease in investment returns, as the value of money decreases over time.

What strategies can governments employ to manage inflation?

Governments can employ various strategies to manage inflation such as monetary policy and fiscal policy. Monetary policy involves controlling the money supply and interest rates to influence inflation rates. Fiscal policy involves changing government spending and taxation to influence inflation rates. Governments can also use price controls and regulations to influence prices and prevent inflation.

How do inflation trends compare historically?

Inflation trends have varied throughout history. In the United States, inflation rates were high during the 1970s and early 1980s, but have been relatively low since then. Inflation rates have been higher in other countries, such as Venezuela and Zimbabwe, where hyperinflation has occurred. Overall, inflation rates have been influenced by various factors such as wars, natural disasters, government policies, and economic growth.